Getting an Entity EIN

Getting an EIN for your Trading Entity

It is highly recommended to get an Employer Identification Number (EIN) for your trading entity. You will probably not have "employees" but and EIN is also known as a Taxpayer Identification Number.

This page shows a walk-through of how to get your taxpayer identification number using the IRS website. Although it changes from time-to-time, the path should be similar.

A word of warning though, be sure to have your Entity Name from your State first. It will be input during this process and if you input an incorrect name, you just created a compliance requirement for an entity that does not exist and will take a tax professional (CPA or attorney) to dissolve.

This process is current as of 11/1/2017 so when you go to www.irs.gov you should see the following:

Type 'www.irs.gov' into your web browser or simply click the link to be taken to the IRS Home page

Some general instructions and time limits; Your EIN will be generated at the end of the session as a pdf which you can download then.

Choose the legal structure of your Trading Entity.

If you choose Corporation you will need to choose the type of corporation.

If you choose Limited Liability Company you are provided some general information about LLCs.

Next you input the number of LLC 'Members' and your State of organization.

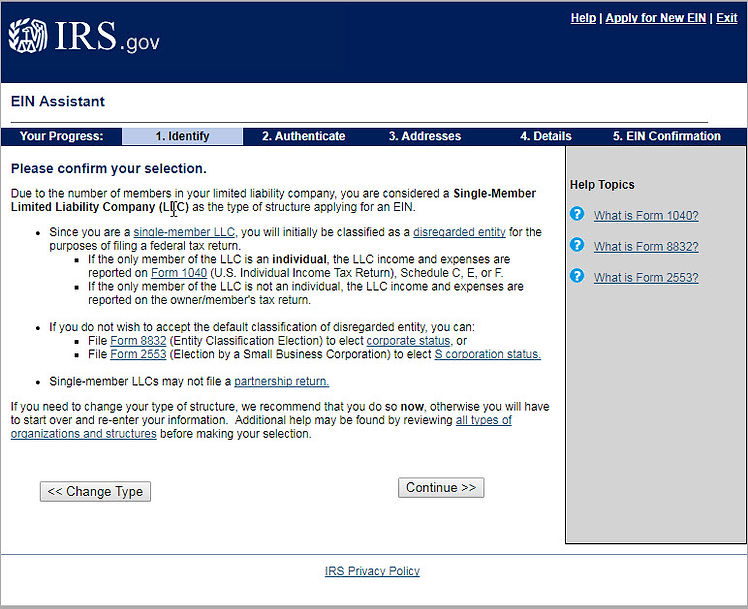

Depending on the number of 'Members' you will receive some reporting information for your new entity.

Select your reason for requesting an EIN; More than likely it will be a new business.

Next you will declare who/what is the Responsible Party of the LLC.

IRS will authenticate the SSN of the Responsible Party.

Tell IRS where your new entity will be located, PO Boxes are not allowed.

Input the legal name of your Trading Entity here that you registered with your State.

Final Matters

Once you click 'Continue' you will be asked to review your input and make any changes, if necessary.

When you finalize the process you can download your EIN as a pdf (Form SS-4) and in the middle of the page it will provide filing information depending on the type of entity you establish.

Anytime before you complete the process you can exit but all your previous responses will be lost. This is a good safeguard so that if you do not know the answer to one of the questions you can exit and research it or ask a tax professional. DO NOT simply complete the application process. You will end up with a "non-entity" that you have file a tax return for or face IRS scrutiny. Plus, you will probably have to pay a tax professional to dissolve what you "created".